How Can We Help?

Fiat Currency Graveyard: A History of Monetary Folly

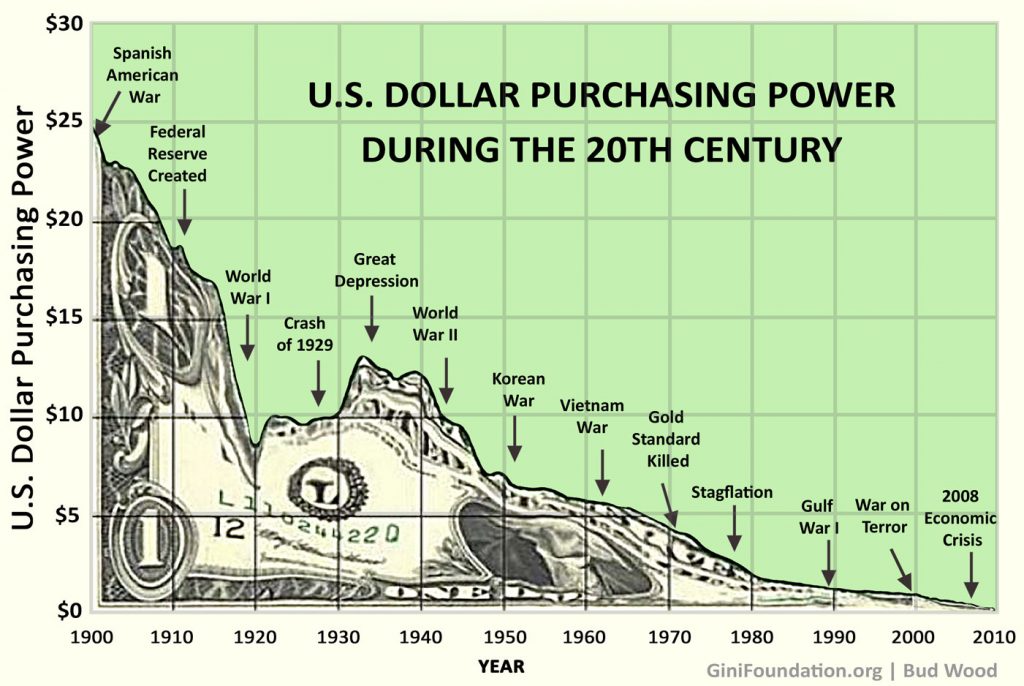

Living in Denial About the Economy. I still see many Americans living in denial about the fate of the USD. Even when they know that past performance is not a guarantee of future performance, they still say things like "Yes, the 2008 bailouts were bad, but our economy has stabilized and we'll be OK." No, the economy will not be OK, and the chart below illustrates why.

Money Printing Is Wealth Theft. As the chart below illustrates, the money printing in the U.S. since 1900 has destroyed 98% of the USD's value. But what happens to the value of the USD when the money supply shoots up like a missile as has occurred since 2008? It loses even more value and will eventually and inevitably collapse, along with the value of every asset that is denominated in USD. This has happened many times in recent and not-so-recent history; and when it happens, the currency is usually killed and buried in the fiat currency graveyard.

The Fiat Currency Graveyard

The Average Lifespan of a Fiat Currency is About 35 Years. The following list of currencies is a small sample of all the fiat currencies throughout the past 1,000 years that have collapsed due to corrupt and/or incompetent monetary policymaking. Hyperinflation is one of the most common precursors to a fiat currency's collapse. Keep in mind that most of these currencies below collapsed within the lifetime of most Baby Boomers living today. So, hyperinflation and currency collapses are not exceptionally rare events. In fact, the average lifespan of a fiat currency is only about 35 years, which means these events happen much more frequently than many people realize.

Peru – 100,000 intis, 1989

Russia – 10,000 rubles, 1992

Zaire – 5 million zaires, 1992

Hungary – 10 million pengo, 1945

Germany – 1 billion mark, 1923

Zimbabwe – 100 trillion dollars, 2006

Greece – 25,000 drachmas, 1943

Central Bank of China – 10,000 CGU, 1947

Venezuela – 10,000 bolívares, 2002

Yugoslavia – 10 billion dinar, 1993

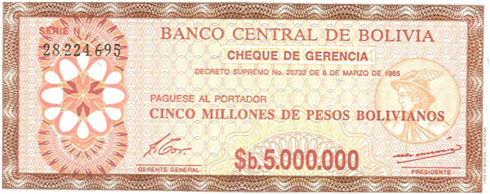

Bolivia – 5 million pesos bolivianos, 1985

Angola – 500,000 kwanzas reajustados, 1995

Ukraine – 10,000 karbovantsiv, 1995

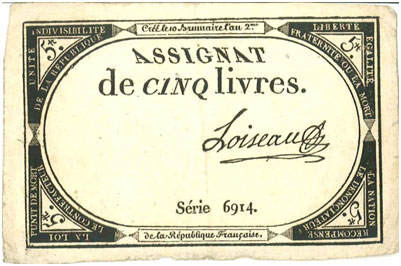

France – 5 livres, 1793

Turkey – 5 million lira, 1997

Georgia – 1 million laris, 1994

Brazil – 500 cruzeiros reais, 1993

Argentina – 10,000 pesos argentinos, 1985

Nicaragua – 10 million córdobas, 1990

Belarus – 100,000 rubles, 1996

Chile – 10,000 pesos, 1975

Romania – 50,000 lei, 2001

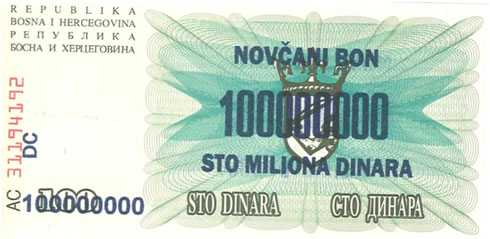

Bosnia – 100 million dinar, 1993

Did You Like This Resource?

Gini is doing important work that no other organization is willing or able to do. Please support us by joining the Gini Newsletter below to be alerted about important Gini news and events and follow Gini on Twitter.