Why Does Humanity Need Cryptocurrencies?

If you truly understand what you’re about to read, you will understand why the scope and impact of Gini is potentially more revolutionary than the American Revolution. That may seem grandiose at this early stage of your Gini journey, but Gini can realistically impact humanity on a global scale and within the lifespan of virtually every human living today. We are honored and inspired to be part of this peaceful revolution and we hope you will join us.

After publishing the best-selling book, Broken Capitalism: This Is How We Fix it, we produced the Gini book, which provides a deeper explanation of what Gini means to human civilization. There are many interesting insights that you can gain from the book, but for people who just want a brief overview of Gini and our mission, continue reading.

Learning Step-by-Step. Gini is a deep project. To truly appreciate why Gini is so important and valuable for our global economy, our political freedoms, and our human rights, we need to review a few foundational principles. If you want to understand how you can benefit from the Gini ecosystem, then the most efficient way to learn everything you need to know to make an informed decision is to first watch the Gini movie, then follow the step-by-step flow of this page. Let's get started.

What is Value?

As explained in much deeper detail in our book, Broken Capitalism, “value” represents an abstract principle that permeates every aspect of human existence. The flow of value in human relationships and societies enables humanity to innovate, build amazing technologies, construct the tallest skyscrapers, and experience the most intimate love between romantic partners. We exchange value with others when we buy their products and services, recognize their accomplishments, hug them at dinner parties, and engage in sensual intercourse. In short, value is what drives human civilization forward to achieve ever-greater heights in every dimension of human existence.

What is Money?

Money is how we exchange value between humans, organizations, and automated nodes on computer networks. Money gives us the ability to buy and sell goods and services. Money represents the value that we see, exchange, and experience when we use tangible products and intangible intellectual property. Money is what enables human societies to create economic systems, which enables us to efficiently organize resources, accumulate wealth, and deploy our accumulated wealth in the form of capital investments that fuel the growth of companies and entrepreneurial dreams. In short, money gives us a more concrete way of measuring and managing the flow of value in human societies so that we can individually and collectively achieve the quality of life that we desire.

What is a Currency?

Money and currencies are not synonymous. Money can be anything (coins, fiat and cryptocurrencies, apples, lollipops, baseball cards, etc.) used to exchange value between two entities. In contrast, currencies have a much more rigid definition and purpose. Specifically, currencies must fulfill three fundamental requirements:

- Medium of Exchange. A currency is a medium through which we measure and exchange value with others. In this respect, it is functionally the same as money, but money becomes a currency when it embodies the other two characteristics below.

- Store of Value. A currency enables us to store value in it for later use. This is how wealth is accumulated for a rainy day or future investment. An example is gold coins: We can store value in them and then exchange that value later for other kinds of value that we need or desire.

- Unit of Account. When you buy and sell anything, how do you count the money you use to buy it? How do you count the profits and losses when managing a business? What do you print on receipts to record how much money (value) you have spent in exchange for the value received? Accounting systems of all kinds help us answer these questions. In fact, every accounting system depends on a unit of account to ensure that the units of value that are used in each transaction are mutually understood and mutually acceptable between counterparties.

What is a Cryptocurrency?

A well-designed cryptocurrency has all the essential features of any other currency (medium of exchange, store of value, unit of account), but certain cryptocurrencies also have several other useful characteristics that imbue them with even more intrinsic value than their fiat currency counterparts. These additional characteristics are:

Privacy

Privacy is a Fundamental Human Right. A well-designed cryptocurrency provides a level of privacy that cannot be achieved by other payment mechanisms like credit cards, PayPal, and bank cash deposits. "But if we don’t have anything to hide, why does privacy matter?” is a comment we’ve heard government officials make to justify their ubiquitous NSA surveillance programs. The next time somebody says something like that to you, simply say, “Please give me the passwords to your bank accounts, email accounts, social security number, and let me install an Internet camera in your bedroom.” They will never give you those private pieces of information because that would force them to behave in an unnatural, uncomfortable, and unfulfilling way from that day forward. The same is true of any form of surveillance. Thus, privacy is a fundamental human right, regardless of whether the word “privacy” is any national constitution.

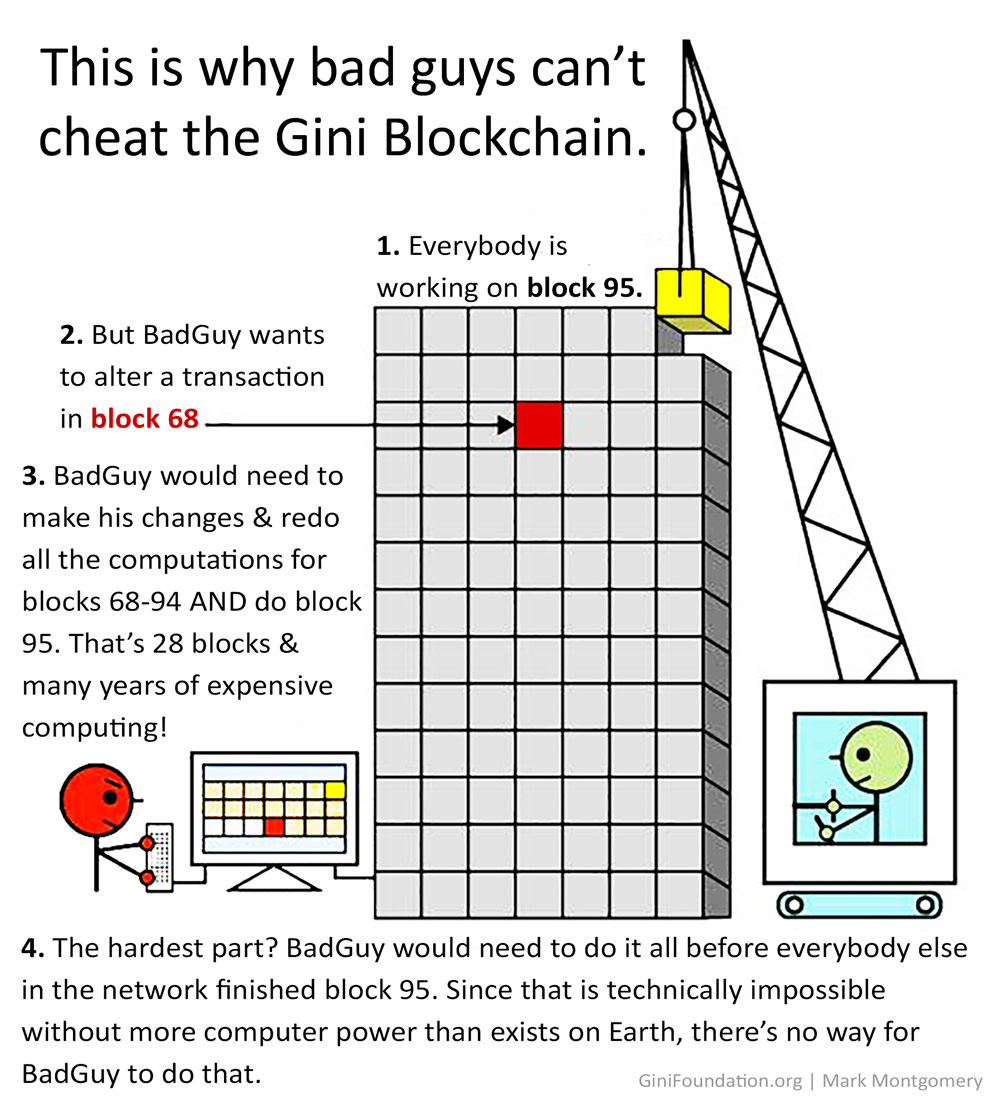

Tamper-Proof & Secure

Cryptocurrencies Can Prevent USD Trillions in Fraud Costs. Unlike all other forms of payment that can be manipulated by criminals, monopolistic banks, self-serving corporate executives, and corrupt governments, cryptocurrencies are stored on a blockchain (more on this later), which prevents any person or entity from manipulating a transaction record after it has been recorded on the blockchain. Based on the principle that "a penny saved is a penny earned," and considering that the combined cost of fraud in the eCommerce sector, retail sector, mortgage lending industry, corporate accounting, and securities trading is measured in USD trillions, the tamper-proof feature alone would be sufficient to substantiate the intrinsic value of a well-designed cryptocurrency.

Cryptocurrencies Can Prevent USD Trillions in Fraud Costs. Unlike all other forms of payment that can be manipulated by criminals, monopolistic banks, self-serving corporate executives, and corrupt governments, cryptocurrencies are stored on a blockchain (more on this later), which prevents any person or entity from manipulating a transaction record after it has been recorded on the blockchain. Based on the principle that "a penny saved is a penny earned," and considering that the combined cost of fraud in the eCommerce sector, retail sector, mortgage lending industry, corporate accounting, and securities trading is measured in USD trillions, the tamper-proof feature alone would be sufficient to substantiate the intrinsic value of a well-designed cryptocurrency.

Are Cryptocurrencies More Valuable than Gold? The global economy is valued at approximately $100 trillion (in 2018) and the amount of fraud is often estimated at between 10-20% of global economic activity. That means the tamper-proof benefit alone of a well-designed cryptocurrency can be estimated at up to $20 trillion, not including all the other benefits. Considering that the global gold market is valued at only about $7.5 trillion (2017 World Gold Council estimate), the tamper-proofing value of a well-designed cryptocurrency justifies an aggregate market price that is at least $10 trillion greater than the $7.5 trillion global gold market.

Dear Gold-Bugs. Before the emergence of cryptocurrencies, Gini's team were all gold-bugs for all the usual reasons; so, we really do appreciate the unique historical role that precious metals have served in many economies throughout human history. However, this analysis is about objective reality, not fear, uncertainty, and doubt (FUD). People who dismiss cryptocurrencies as inferior to gold don't truly understand why cryptocurrencies are valuable, which means they don't truly understand the following:

- "Value" in a modern global economy is increasingly based on the fluid flow of intangible ideas, the intangible trustworthiness of cryptographically secure data and information systems, the intangible trustworthiness of incorruptible institutions based on decentralized political and economic power structures. . . . These are the essential foundations of virtually every tangible product/service in every modern economy. Gold has virtually no place, purpose, or relevance in any of these domains of modern economic activity; thus, it has virtually no place, purpose, or relevance in modern human civilization beyond its industrial and jewelry-making value.

- Precious metals prices can be manipulated by governments, central banks, and powerful economic actors far more easily than the price of cryptocurrencies at scale (i.e., when they are used for a significant percentage of an economy's total economic activity).

- Gold encourages centralization of gold reserves. The logistical, security, and insurance requirements to manage gold safely requires vault operators to spend USD millions on very expensive facilities. This inevitably leads to high concentrations of gold in centralized vaulting facilities because only the largest and most well-funded vault corporations can afford to operate these facilities effectively. Centralization makes your gold highly vulnerable to political events, government confiscation, and many forms of corporate manipulation and institutional corruption.

- It's easy for governments to confiscate your precious metals (as has happened multiple times in multiple countries in the past with gold and silver); while it's virtually impossible for the government to confiscate your cryptocurrencies if you manage them properly.

- Gold keeps giant banks at the center of the economic system. The vast majority of gold bullion on Earth is held and controlled by giant commercial and central banks. Any economy that is based on a commodity that banks control is controlled by the banks. Anybody who is truly aware of the never-ending history of banking corruption and scandals would never want their economy to be controlled by these corrupt entities.

Counterfeit-Proof

Unlike all fiat currencies, it’s impossible to counterfeit a well-designed, decentralized cryptocurrency that is stored on a cryptographically secure blockchain.

Government-Issued Cryptocurrencies Are Still Fiat Currencies. Due to the many benefits of cryptocurrencies, many governments today are considering the possibility of converting their fiat currencies into cryptocurrencies. However, they will still be fiat currencies because they will still be vulnerable to official counterfeiting by corrupt and incompetent governments and banks. To eliminate any doubt, yes, money printing, quantitative easing, and fractional reserve lending are all forms of official counterfeiting, regardless of what self-serving political and banking officials may claim. A government's legal monopoly on counterfeiting based on its ability to coerce citizens at the barrel of a gun (or a long prison sentence) does not change this reality.

Government-Proof

Many politicians on Earth today don’t know what they’re doing. (The Global Governance Scorecard confirms this.) In many countries today, politicians are manipulating their national currencies, incurring huge and unsustainable debts, and destroying their economies. To cover up their own mistakes, they’re probably also planning to control the capital flows in their economies by implementing unjust bank bail-ins and other anti-democratic measures to prevent their citizens from escaping the economic tyranny they’ve spawned with their short-sighted and broken economic policies.

To be clear, this is not a gratuitous attack on politicians or governments; it’s simply the objective reality of Broken Capitalism on Earth today, which is destroying our global economy, eviscerating the middle class in many countries, spawning increased tensions between countries, and thus, creating the conditions for violent conflicts and wars. Cryptocurrencies prevent rogue governments from destroying our wealth, our economies, and the quality of our lives.

Price Stability

Although the price of many cryptocurrencies today is more volatile than many fiat currencies, certain cryptocurrencies are fundamentally designed to achieve more price stability as their markets grow. Gini, in particular, is designed with specific features that are intended to make its market price more stable than other cryptocurrencies (and many fiat currencies). As the demand for Gini grows, the inherent price-stabilizing mechanisms of the Gini blockchain are expected to continue reducing the price volatility of the Gini currency over time.

Long-Term Value Preservation

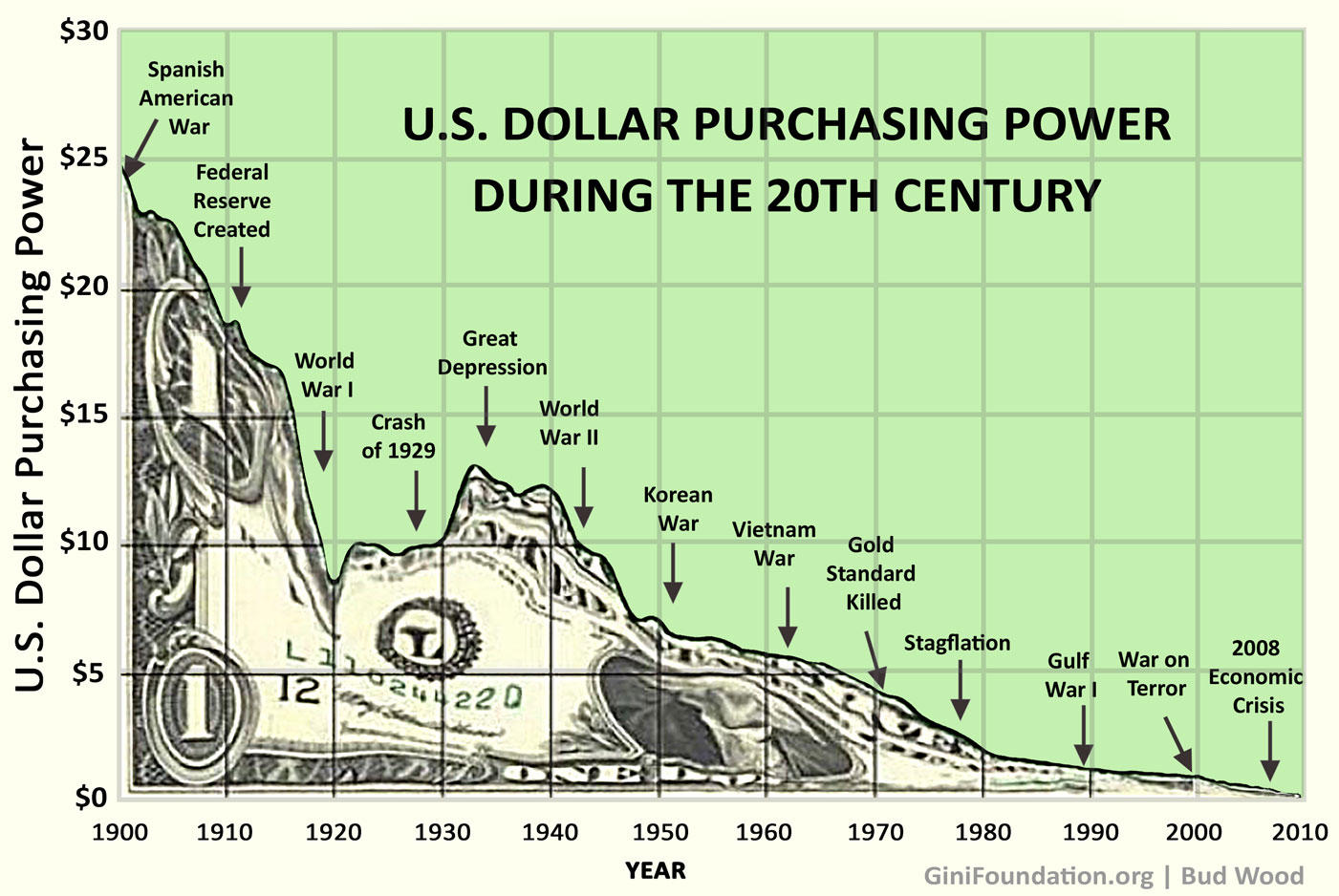

Collapsing Fiat Currency Value. The chart below illustrates how the U.S. Dollar has lost over 98% of its value since the beginning of the 20th Century. That’s not an accident: The beginning of the 20th Century is precisely the time when senior U.S. politicians began launching foreign wars primarily (not always) to spread U.S. economic imperialism under the false flag of spreading democracy. Contrary to the principle of consensual democratic governance, these wars force citizens to endure tragic costs in life and wealth, resulting in immoral debts that are thrust upon future generations. We have now reached a negative tipping point in human history and the cycle of wars and debts is choking the life out of humanity economically and socially.

Killing the USD and Our Wealth. The loss of over 98% of the U.S. Dollar’s value is the inevitable consequence of how the broken fractional-reserve banking system works. Visualize the mutilated dollar bill in the chart above being stabbed with a butcher knife, slashed with a machete, hacked with a chainsaw, acid poured on its face, and brutalized like a domestic violence victim—that’s the tragic crime that U.S. politicians have committed against the U.S. Dollar and American citizens since the beginning of the 20th Century. Now, U.S. politicians are dragging the USD into the fiat currency graveyard.

The Collusion Between Governments and Corporations Destroys the Value of Our Money. Politicians in many countries have abused their fiat currencies by funding illegitimate and immoral wars and bank bailouts, both of which are massive corporate welfare programs for the military-industrial complex and the banking sector. Even when politicians claim to be providing beneficial social welfare programs to help the poor and indigent, those programs metastasize into financially unsustainable bureaucratic monsters. Why? Because politicians give their favorite corporate donors no-bid contracts, tax-breaks, and artificially high prices for the goods and services that they sell to the government. All these social programs would be much more sustainable if the politicians were acting in good faith, without corporate corruption, and with honest money.

Gini Restores Trust in Money. Cryptocurrencies like Gini cannot be manipulated by banks, corporations, or governments, which means no politician is going to ever be able to deflate the value of a well-designed cryptocurrency like Gini.

What Have We Learned So Far?

Let’s summarize what we’ve learned so far:

- Value flows through every dimension of human civilization, which enables us to create wonderful things and achieve the quality of life we desire.

- Money enables us to measure and manage the flow of value in economic transactions.

- Currencies ensure that we can efficiently and accurately keep track of the value we exchange with others.

- Governments, banks, and large corporations have destroyed the value of fiat currencies, shackled us with unsustainable and asphyxiating debts, and are leading us to violent wars.

- All these problems will inevitably get much worse as artificial intelligence, automated robots, the "Internet of Things" (IoT), ubiquitous government surveillance, and the hyper-concentration of political and economic power continues to erode our freedom and the integrity of economies and human societies worldwide.

- Cryptocurrencies provide all the benefits of fiat currencies (medium of exchange, store of value, unit of account), but they also have several additional benefits that prevent politicians and corporations from destroying our economies, our societies, our lives, and our planet.

Next Step: How Do Blockchain Technologies Work? Now you know why blockchains and cryptocurrencies are essential for the next phase of human civilization. Now let's jump up to section 2 above and briefly cover how they actually work.