How Can We Help?

How to Survive Cryptocurrency Storms?

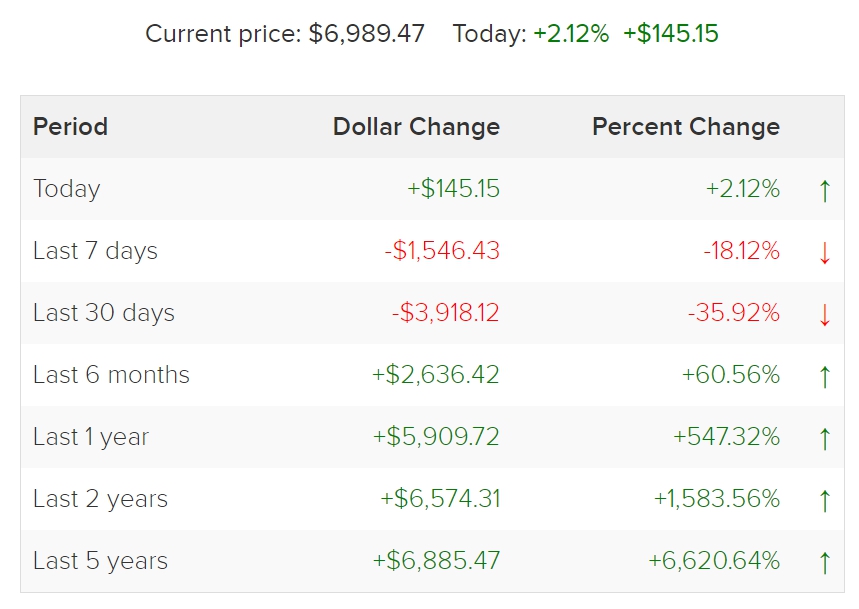

Since the beginning of 2018, the cryptocurrency markets have been on a wild ride. Total cryptocurrency market capitalization reached $832 billion on January 7th, 2018. As of March 30th, 2018, crypto market cap is down to $272 billion, which is a 67% decline from the record highs in January. That seems bad, but it’s not even close to the worst market crash in Bitcoin’s history; so, we should always place all market dynamics into their proper historical context. To illustrate the wild ride we’ve been on for the past five years, Bitcoin’s historical price action as of March 30, 2018, is summarized in the table below.

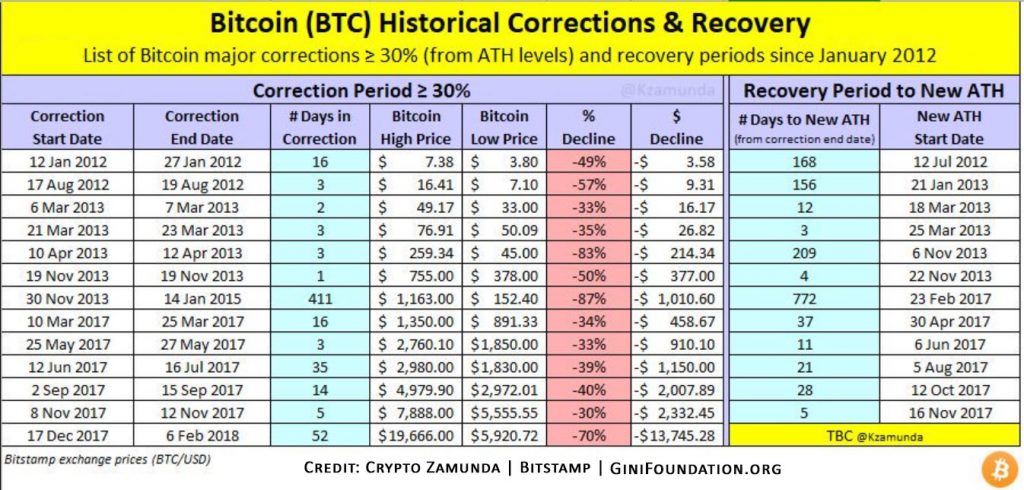

The following table illustrates the time that was required for the price of Bitcoin to recover from its many historical recessions, some of which were much worse than the current crypto market recession that we are experiencing now.

Bitcoin Correlation with Altcoins. Bitcoin’s price is currently highly correlated with other cryptocurrencies. This correlation will not always be so strong, but the correlation issue is still important to understand now because Bitcoin has been in a bubble, relative to the price action of any asset class in the fiat economy. The result is that when Bitcoin’s bubble deflates, it violently drags the entire cryptocurrency market down with it, even when the technical strengths of other cryptos are strong in ways that should offset Bitcoin’s technical weaknesses. This is not rational market price behavior; and when markets are not behaving rationally, eventually they restructure organically around more rational behavior, which is the natural progression for every market.

Other Dynamics Affecting Cryptocurrency Market Prices. In addition to the Bitcoin bubble correlation, it’s useful to understand the other dynamics that have been causing the latest round of market price suppression. All these dynamics are arguably external to the industry itself. This suggests that the underlying value of cryptocurrencies and blockchain technologies has not changed, but price action is more volatile lately because crypto investor sentiment has been impacted by the following events.

Taxes. During tax season, many people are compelled to sell assets to cover their tax liabilities, which tends to put downward pressure on asset prices, especially in speculative asset markets. Over the past year or so, government authorities in several countries have been trying to crack down on tax evasion that is increasingly facilitated by cryptocurrencies. As more crypto holders become aware of the tax-evasion risks involved, they are increasingly treating their cryptocurrencies more conservatively just as they would any other asset. This is a sign of long-run market maturation, but in the short-run, it will have a suppressive impact on prices.

Regulatory Uncertainty. Several governments (including China, Russia, and the U.S.) have recently made announcements about their regulatory perspective on cryptocurrencies. For example, the U.S. Securities and Exchange Commission (SEC) has recently issued subpoenas to several companies that the SEC believes have misrepresented their Initial Coin Offerings (ICOs). Many of these companies have engaged in fraud and deceptive practices, which have caused some investors to collectively lose USD hundreds of millions. Of course, this is a drop in the bucket compared to the USD trillions that too-big-to-fail banks have destroyed and/or siphoned out of the fiat economy, but fraudulent activity is disgusting for everybody in the crypto industry; so, we welcome the increased regulatory scrutiny of pump-and-dump schemes and other deceptive ICO practices.

Political System Effects. Even though SEC scrutiny has generally been focused on bogus and deceptive ICOs, there is now a growing perception that Big Government is trying to stomp on the cryptocurrency industry. There are certainly some politicians who don’t like crypto, but this is not true in all cases. Of course, there are political dynamics associated with all economic and regulatory policies, but we have seen most politicians in the U.S. Congress and parliamentary hearings in other national governments discussing cryptocurrencies in good faith. In fact, most of the time, they’re simply trying to understand how cryptocurrencies work and how they could potentially be used both for good and illicit purposes.

Recalibration of Industry Communications. Increased regulatory scrutiny naturally injects some healthy fear into the fraudsters, which is causing a general recalibration of the historically over-hyped marketing and communications used for bogus ICOs. This is having a suppressive impact on prices because it makes it harder to perpetrate pump-and-dump scams, but it’s also creating more rational and transparent communications within the industry, which is a healthy sign of industry maturation. As the industry moves toward a more mature communications framework, we anticipate that market expectations will stabilize along with market prices.

Advertising Restrictions. Several large advertising platforms, including Google, Facebook, and Twitter have announced that they will prohibit paid ICO advertising on their platforms. There is widespread speculation that these decisions are in response to government pressures, but they’re also likely in response to their own self-interest as they recognize that many new decentralized blockchain projects will threaten their centralized business models. Regardless, credible blockchain projects rarely pay for advertising on those platforms anyway because natural viral social sharing is the best form of advertising. The social media giants cannot and will not restrict organic, non-paid social media sharing of credible ICOs that are popular for legitimate reasons.

Storms Occur in Every Ecosystem. The blockchain industry today is innovating and creating unique value at a faster pace than any industry in human history, but the dynamics above have created a dark cloud of uncertainty over the industry. Indeed, it’s a perfect storm, which we have been expecting for years because every market goes through the same maturation cycle. It’s never possible to predict the precise timing, but we know from history that market storms are as inevitable as the storms in the natural world. Before hurricanes blow through our neighborhoods, wise humans make sure the structural foundations of our property are strong enough to weather the storm. Then we try to relax and let nature take its course.

Market Cycles Are a Fact of Life. In the early 1990s, a similar cycle occurred with regard to the Internet: Like the cryptocurrency markets today, many people in the early 1990s incorrectly assumed that only criminals and technical geniuses had any need for the Internet. The past 20 years have proven them wrong, while the market crashes of 2000 and 2008 have reminded us of an age-old lesson: From the beginning of the Industrial Revolution in the early 1700s, every new market has been accompanied by price volatility and regulatory uncertainty. But all markets eventually become mature, wealth-generating industries for the people who have the discipline, wisdom, skill, and patience to navigate the market storms effectively.

Remembering the Existential Value of Cryptocurrencies. In addition to the fundamental reasons why humanity needs cryptocurrencies, over the past several years, many governments have damaged their fiat currencies and blatantly stolen wealth from their citizens. In 2013, we saw the Cyprus Government arbitrarily confiscate approximately 50% of their citizens’ wealth. Numerous other governments (likely including China) are beginning to adopt the Cyprus strategy as well. To be clear, no matter how they try to pitch it to their citizens, when governments sacrifice innocent depositors to corporate bank shareholders and then steal the depositors’ money to prop up reckless banks, that is theft. The only thing that can protect citizens from the systematic theft perpetrated by their governments is a cryptocurrency that governments cannot steal.

Oh, Dear Canada: Not You, Too! As conveyed in the Global Governance Scorecard, we have great respect for Canadian culture and we have many friends and family in Canada, but the Canadian Government is flirting with the dark side now that they’re playing the rob-the-citizens game. In the Canadian Government’s official “Economic Action Plan,” it states:

Cryptocurrencies Are Essential for a Well-Balanced Asset Portfolio. For all the reasons above, there will be strong and increasing demand for cryptocurrencies for decades to come. Naturally, there will also be cyclical storms as governments try in vain to suppress the supply of crypto, which will only increase the demand and long-run price for most cryptos that are based on strong technical fundamentals. So, there should be no question that holding a portion of our wealth in cryptocurrencies is a necessity in today’s highly unstable (and often corrupt) global economy.

The next logical questions are: “How much?” and “which cryptocurrency is the best?” As to the “how much?” question, of course, each person has a different financial situation, but in general, we believe cryptocurrencies should represent between 5-10% of a person’s wealth. This is similar to the same portion typically allocated to precious metals within an inflation-hedged portfolio. For the "which crypto?" question, we're biased toward Gini; so, I'll let others answer that question.

Did You Like This Resource?

Gini is doing important work that no other organization is willing or able to do. Please support us by joining the Gini Newsletter below to be alerted about important Gini news and events and follow Gini on Twitter.