How Can We Help?

Can Gini Reach $10,000 Like Bitcoin?

Somebody recently asked me: "Can other cryptocurrencies reach the $10,000 point like Bitcoin?" Below is a summary of my responses.

Yes, the Price of Any Well-Designed Cryptocurrency Can Reach $10,000 and Far Higher. To understand why this is true, we need to understand how asset prices and economic price levels work. The price of any asset is based on the currency in which it is denominated. The price of any currency is determined by its exchange rate. The exchange rate is determined by the balance of payments between countries (which is determined by their Current Account and Capital Account), the presence/absence of trade deficits, the prevailing interbank lending rate, the (in)competence of economic policymakers and central bankers in managing the money supply and interest rates, bondholders’ perception of a country’s ability to pay its debts . . . and several other factors.

Asset Prices Depend on Economy-Wide Price Levels. All the factors above determine the supply/demand of a currency, which determines the currency’s exchange price, which determines the price levels throughout an entire economy for all goods and services. To understand how all this fits together: During the Weimar Germany period after WWI, the cost of a loaf of bread in Germany was 2 trillion Reichsmarks in 1923. Why? Because economically ignorant British, French, and American politicians at the 1918 Paris Peace Conference imposed their short-sighted, ill-fated Versailles Treaty on Germany, which was so economically oppressive on the Germans that it choked Germany's economy to death. This spawned radical Nazism, Hitler, and WWII. Even worse hyperinflation occurred in Hungary (1946) and Zimbabwe (~2008).

What Currency is Gini Denominated In? A currency, like any other asset, can be denominated in any other currency; and a “currency” can be anything. In fact, an asset/currency can be denominated in USD, EUR, gold, lollipops, apples, baseball cards, Pokémon, cigarettes . . . literally anything that two or more counterparties mutually agree has exchange value. So, when we talk about the “price” of anything, we’re really talking about its relative price to some other thing. The same item (e.g., a kilo of gold) can simultaneously have a “price” of 250,000 apples, 4 million Japanese Yen, 100,000 Pokémon, USD45,000, and 1 million lollipops. Thus, the question is not whether the “price” of Gini (or any other cryptocurrency) can ever reach $10,000; it’s what currency are we pricing Gini in; and if the price of Gini is denominated in USD, then what will the price of Gini be relative to the price of USD?

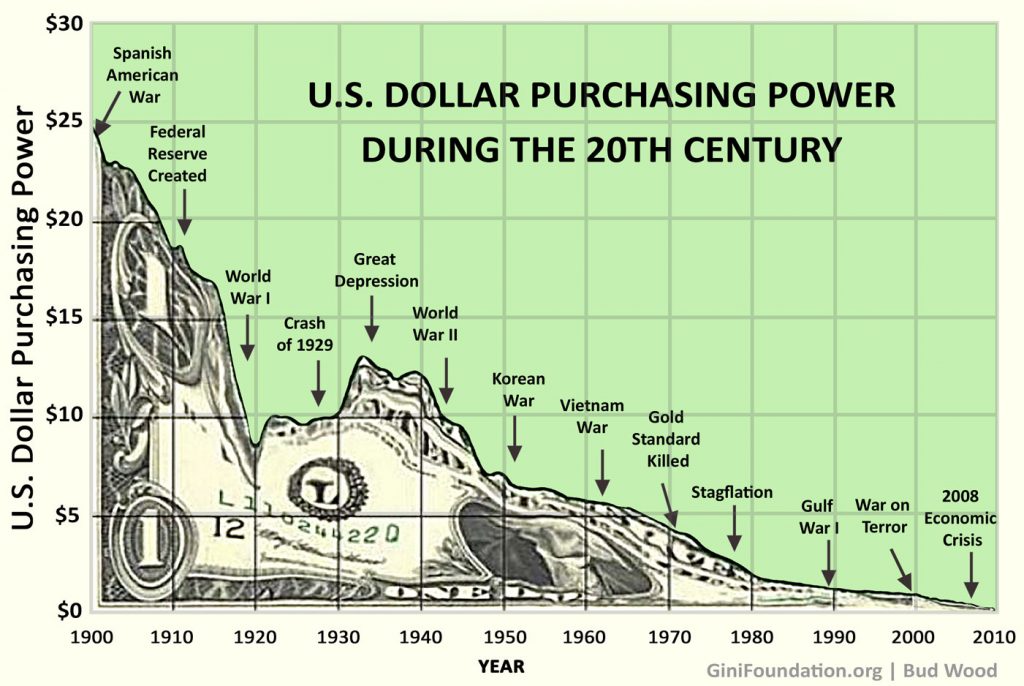

USD Inflation. A newspaper cost $0.01 in the year 1900. Today, the price of a newspaper is 500-1,000 times higher (depending on the paper). Why? Because, starting with the Spanish-American War in 1899, U.S. politicians have been engaged in foreign wars to spread economic imperialism under the false flag of “spreading democracy.” Each one of these wars has cost billions or trillions of USD. By the time the Federal Reserve was spawned from Jekyll Island in 1913, the USD had already lost nearly 30% of its value because the USG already had a printing press running at full speed.

The Cycle of War, Debt, Inflation, USD Debasement. Thus, the Fed is not the primary cause of the destruction of the USD; the Fed is merely an enabling mechanism that enables corrupt and/or economically ignorant politicians in the White House and Congress to print money without taking direct political responsibility for printing money. That printed money is then wasted on an endless river of bloody foreign wars and escalating international tensions, which fuels the military-industrial-complex, which fuels more wars, more debts, more USD debasement/inflation, ad infinitum.

Gini to Alpha Centauri and Beyond! Now, we can begin to focus specifically on why Gini (or any well-designed cryptocurrency) can and likely will reach a price of $10,000 and even higher. There is over $1 quadrillion in combined money supply and derivatives contracts on Earth today. Every currency unit, asset, and derivative contract must be denominated in something. As we learned above, it can be denominated in lollipops, USD, Bitcoin, Gini, etc. Most people today would probably rather receive USD, but what happens when the USD collapses like the German Reichsmark because we have incompetent, corrupt, and economically ignorant politicians manipulating our money supply and choking our planet with unsustainable debts? The price of anything denominated in USD will hyperinflate far beyond the Moon; it will inflate to Alpha Centauri. When (not if) that happens, the price of Gini relative to USD will also hyperinflate with the overall price level of everything else in any USD-denominated market.

Wealth Preservation. When currencies hyperinflate, smart investors and citizens rationally do everything possible to protect their wealth from inflation. To accomplish this, they typically move their assets into other currencies that more effectively retain their value. (This is the “store of value” function of a currency.) When the USD and most other fiat currencies hyperinflate, what will humanity do to protect the value of their wealth?

Communities Drive Value. If we, as a community, have done our job, humanity will naturally move a large portion of the $1 quadrillion of money supply and derivatives (humanity’s current “wealth”) into crypto-denominated assets, ideally crypto assets like Gini with sustainable monetary policies. That will simultaneously increase the exchange rate price of those crypto assets relative to USD, decrease the exchange rate price of USD relative to those crypto assets, and increase the intrinsic demand for those crypto assets, which will also increase Gini's price relative to all other fiat currencies because of the law of supply/demand with respect to any scarce resource.

Bottom Line. The USD is doomed to the fiat currency graveyard along with every other fiat currency that has come and gone throughout human history. Nobody can predict the exact timing of their collapse, but the factors that have caused the USD to lose over 98% of its value since 1900 are only getting worse for many reasons. This means the USD debasement and corresponding inflation is accelerating. That means the price of all USD-denominated assets and currencies will rise in direct proportion to the USD debasement/inflation. So, it’s not only possible for Gini (and any other well-designed cryptocurrency) to hit $10,000, it’s virtually inevitable.

A Penny Saved is a Penny Earned. In portfolio risk management, mitigating losses is even more important than maximizing profits because the human brain/emotions respond far more negatively to losing things than gaining things. (Many studies have confirmed this.) This psycho-biological dynamic is what drives the vast majority of the volume of institutional financial markets on Earth today. That’s why I've focused on wealth preservation up to this point. However, somebody recently asked, "But will the actual purchasing power of a cryptocurrency increase or just offset the collapsing value of the USD?"

4 Primary Mechanisms That Will Increase Gini Real Wealth. What I've explained above represents three mechanisms that will likely cause Gini's relative and absolute value (purchasing power) to increase during the coming USD inflationary collapse. Here they are in more succinct form:(1) Inflationary price spikes (relative value increase).

(2) Intrinsic real value appreciation of Gini (and any well-designed crypto) due to natural supply/demand dynamics.

(3) Intrinsic real value appreciation due to an inevitable economic structural shift away from fiat and toward the most reliable cryptos. (Affects supply/demand, but originates from a different causal source.)

(4) Bonus for Gini stakeholders: x%/year return on our loyalty to the platform in the form of Gini's unique Value Streams.

Pennies Saved AND Earned = More Real Wealth. When everybody else is buying $10,000 hamburgers with depreciating USD, those with appreciating Gini (and other well-designed cryptos) will have preserved and earned significantly more real wealth than fiat holders. That means they will be able to buy more $10,000 hamburgers than anybody else who is trapped in fiat hell.

Did You Like This Resource?

Gini is doing important work that no other organization is willing or able to do. Please support us by joining the Gini Newsletter below to be alerted about important Gini news and events and follow Gini on Twitter.