How Can We Help?

Weaponized Wealth Concentration Destroys Economies

In addition to the technical economic factors discussed in What Caused the Great Depression, in 1929 just before the massive stock market crash, 33% of U.S. national income went to the top-5% of the income-earning population.1 This high concentration of income at the top of the distribution ladder had many negative consequences that directly caused and amplified the Great Depression. Some people are bored by history; so before we cover what happened before and during the Great Depression, let's briefly explore why this is so relevant today.

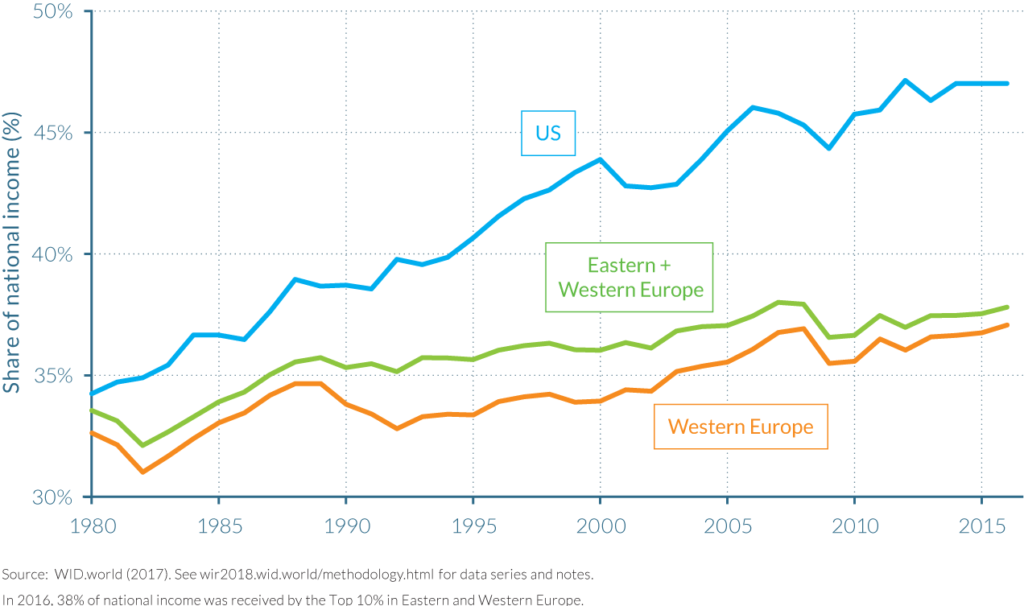

Today, the actual economic structural conditions of the U.S. economy are much worse than in 1929, contrary to the propaganda we see from Wall Street, the White House, Congress and the financial news media. In fact, nearly 50% of U.S. national income goes to the top-10% of the population, but the vast majority of that income goes to the top-1%. The chart below illustrates the distribution of national income to the top-10% of the population in the U.S. vs. Europe.

The chart below illustrates how the bottom-50% of the U.S. population (aka, the middle class) is rapidly sliding into poverty. This is caused by the real unemployment/underemployment rate, the collapse of the human labor force, and the grossly inequitable and short-sighted economic policies that distort the national income distribution.

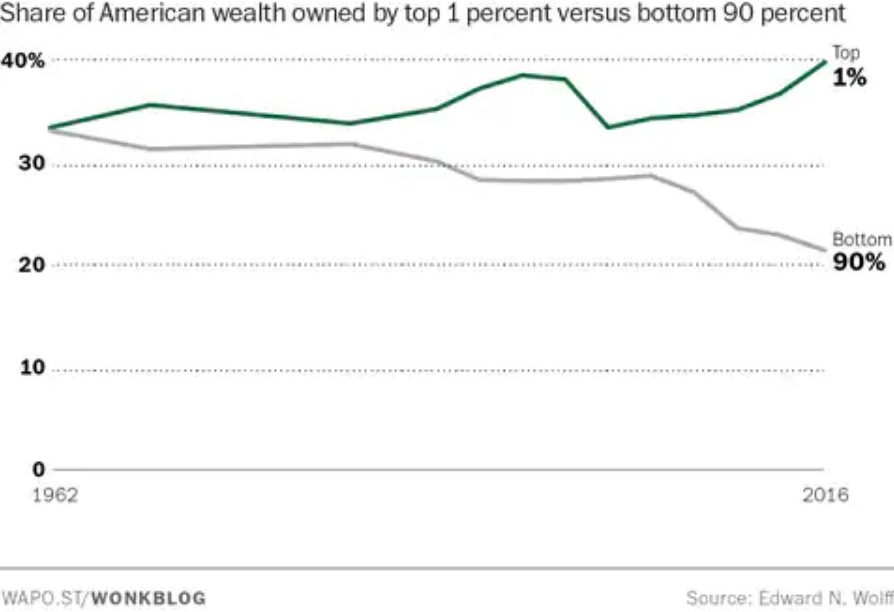

About 43% of U.S. national wealth (excluding primary home) has been captured by the top-1% alone; 93% goes to the top-20%. Thus, less than 7% of all national non-home wealth is owned by the bottom-80% of the population.2 The chart below illustrates that the top-1% has nearly two times as much wealth as the bottom 90% of the entire U.S. population combined.

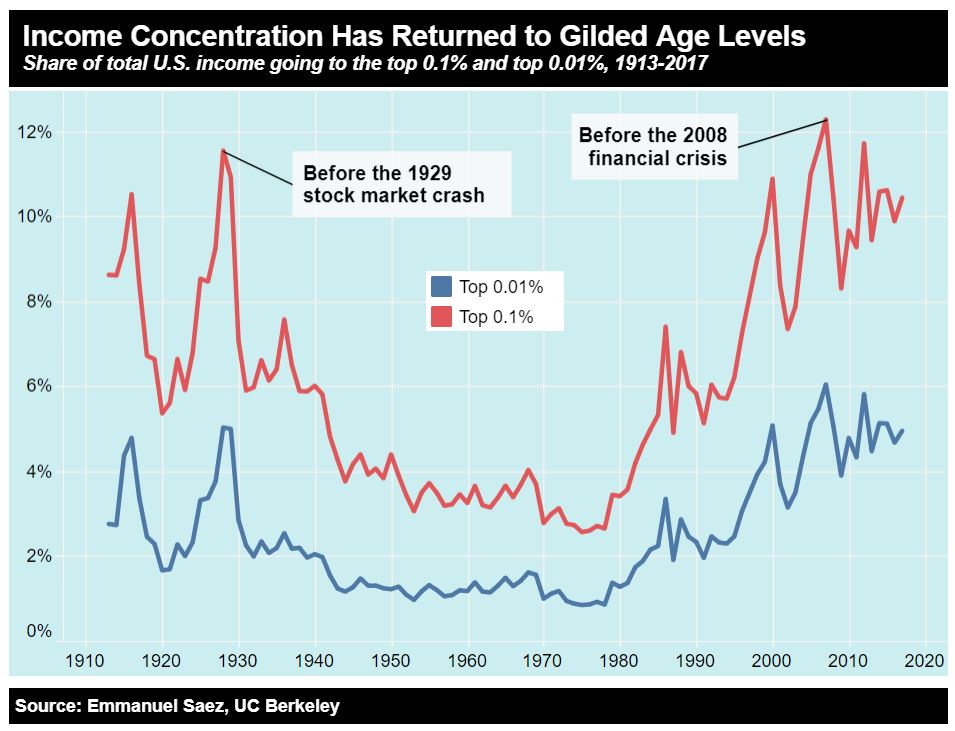

The chart below vividly illustrates how an economy behaves when the distribution of national income is shared more equitably throughout the population compared to when income is highly concentrated at the top. We can see that broadly distributed income correlates very strongly with the Golden Age of the U.S. economy between the 1940s to 1960s. In contrast, highly concentrated incomes correlate very strongly with the Great Depression and the 2008 Financial Crisis.

Given all the following facts . . .

- Wealth concentration in the U.S. today is 2-3 times higher than in 1929.

- Debt at every level of American society is the highest in American history.

- The real unemployment rate is already at Great Depression levels.

- The White House and Congress are more dysfunctional and corrupt than they've been in at least 190 years since President Andrew Jackson's patronage system.

- Giant banks and corporate cannibals are more powerful, concentrated and have more corrupt incentives than ever.

- The stock market is more inflated than ever.

- The bond market is arguably more distorted than ever due to all the factors above.

- The next debt-fueled banking collapse will be too big for any government to bailout.

- The systematic deception, lies and propaganda that permeate the financial and political media are more sophisticated and manipulative than ever.

- Confidence in fiat currencies worldwide is likely to collapse due to all these factors because nobody will know which currency is based on truly sound monetary principles.

. . . we can be certain that the next inevitable economic depression will be at least as traumatic for the U.S. as the Great Depression.

Additionally, given that wealth concentration worldwide today is also higher than it was in the U.S. in 1929, we can expect severe depressions to explode like socioeconomic volcanoes in many countries in the months and years to come. These are precisely the conditions that directly caused WWII and the slaughter of 100 million humans.

Wealth Concentration Destroys Economies

Most conscious humans probably recognize that highly concentrated income/wealth is bad for various sociological reasons, but many people may not realize that high income/wealth concentration is also bad from a systemic economic perspective because it makes economies less resilient during recessions and depressions. This is because there's not enough wealth flowing through the general population to reverse the economic deflationary spiral that occurs during severe recessions and depressions.

Aside from the obvious debt and inventory liquidation process, the deflationary spiral occurs because the poor have no purchasing power to participate in any substantial economic activity to revive the economy. Without growth in real wages and salaries, there's no way for consumer demand to fuel economic growth and corporate profits. Supply-side economic theories collapse under these conditions because the only way an economy can grow at all is if the rich are buying lots of mansions and yachts and other luxuries.

However, luxury purchases can only partially offset the loss of purchasing power in the general population because no matter how much the rich spend on luxuries, their purchases are a small fraction of the massive volume of basic necessities and simple pleasures of life that the much larger general population would purchase if they had more purchasing power. Moreover, the rich generally stop buying yachts and mansions when they're nervous about deteriorating economic conditions.

The people that are so rich that they don't need to worry about money tend to wait until they see an economic bottom in the cycle, then they quickly gobble up the most valuable assets at fire-sale prices, which concentrates the distribution of wealth even more. This pattern of economic activity does nothing to create broad economic growth, much less a robust economy. This is one of the most significant reasons why the Great Depression lasted for a decade compared to the much shorter 1920 depression and all other recessions before and since.

The structure of the U.S. economy during the 1920s was systemically distorted because there was no meaningful regulation of the behavior and power of the financial sector. This resulted in many industries becoming monopolized and financialized by giant, systemically corrupt holding companies and banks. This created vast, interconnected, pyramidal debt and collusive corporate governance concentrations throughout the economy.

These dynamics destabilized the entire economy because corporate executives throughout the economy became corrupted by the same toxic incentive structures that plague the giant banks then and today. These economic structural distortions amplified the 1929 stock market crash and subsequent Great Depression by causing a chain reaction of interconnected banking and corporate defaults and collapses throughout the economy.

These toxic conditions were directly caused by President Calvin Coolidge's extremely hands-off approach to banking and market regulation. This created a tsunami of corporate debt, fraud and larceny that destroyed the wealth and lives of millions of humans.

In contrast, after the economic and regulatory reforms in the 1930s, the structure and distribution of income and wealth in the U.S. economy dramatically changed. By the early 1950s, the concentration of wealth in the hands of the top-5% was reduced from the previous 33% to less than 20%. (Galbraith 1955) Thus, the middle class had much more purchasing power again. These structural economic changes (combined with the WWII economic stimulus) produced the largest, longest and most widely shared real prosperity in U.S. history.

Cruel Fantasies

In contrast to the broadly shared real wealth generated during America's Golden Age, the debt-fueled illusion of prosperity today is a cruel fantasy for the ~80 million working-age Americans who have no job and are ignored by the official unemployment statistics. This population of economic refugees is two times the size of the entire population of Canada. In fact, the real unemployment rate today is over 20%.

For those who don't believe the unemployment rate is that high, think deeply about the charts below. Unlike the deceptive formula that Congress switched to in 1994 to calculate the bogus official unemployment rate, the math is quite simple: There are approximately 206 million working-age adults in the U.S., but only 63% of them have a job according to official BLS statistics (which are probably inflated for political reasons). That means there are at least 76 million working-age adults that do not have a job.

We hear from the media and so-called economic experts that the reason nearly 80 million working-age Americans don't have jobs is because they're lazy and/or the job market is so hot that it's hard to find jobs. Both of these explanations are total nonsense. Here's why:

"Hot Job Market". If the job market is so hot, then the Law of Supply and Demand tells us that real wages and median incomes should be rising rapidly to satisfy labor demand, but wage growth has been stagnant for decades. We can see in the chart below that real median income is barely detectable while consumer debt is the highest in American history.

Latest real median income data is currently only available up to 2017. More recent trend is likely trending downward given the abysmal real unemployment rate.

Latest real median income data is currently only available up to 2017. More recent trend is likely trending downward given the abysmal real unemployment rate.

"Lazy Americans". Certain kinds of welfare programs do create counterproductive incentives for some people, but what suddenly made all these millions of humans lazy in 2001 and 2008 when the job market collapsed in two big waves? Simple: Exploitative banks and transnational cannibal corporations ripped the heart out of the U.S. economy by financializing the entire corporate sector and exporting American jobs to squeeze every penny of profit into the pockets of senior executives and their largest shareholders.

Population Growth. Just to keep up with the 1.8% U.S. annual population growth rate, the U.S. economy must create a certain number of jobs every month. The U.S. economy rarely produces the break-even rate of job growth and is usually far below break-even. Yet, we see frequent media reports like "Strong job growth is back" even when the job growth doesn't even come close to offsetting the population growth. To truly appreciate how deceptive the propaganda machine is, we have to answer a simple question: How many jobs per month should the economy be creating? To compute the minimum job growth target, we need to know a few variables:

Actual Population: ~330 million

Actual Population Growth Rate: 1.8%

Working-Age Population: 65%

Much Healthier Target Labor Force Participation Rate: 80%

The Math. Let's do some simple math: (330 million * 1.8% * 65% * 80%) / 12 = 257,400 new jobs per month must be created just to keep up with population growth (and that number is continuously rising as the population grows). Anything less than that means the labor force participation rate is falling and the real unemployment rate is rising. In fact, this is exactly what has happened during 41 of the past 60 months. Yet, we don't see any of these realities reflected in the official bogus statistics. The chart below helps to visualize this truth.

Many corporate cannibals don't perceive economic crises and mass unemployment as a painful experience like conscious humans. Instead, these cannibals perceive an economic crisis as the perfect opportunity to slash and export more jobs to increase their profit margins, without regard for the catastrophic impact on their home society and economy. This gives them an incentive to collude with politicians to lie about the true condition of the labor force and unemployment rate to divert attention away from their cannibalistic practices. This truth is illustrated by the crisis-correlated permanent downward stair-step trend-line of the labor force participation rate in the chart above.

Many people prefer to ignore these realities; or worse, they claim these are the inevitable outcomes of the Law of Supply and Demand and capitalism. More nonsense. The collapsing labor force is a consequence of specific short-sighted economic, tax, trade and regulatory policies that have been purchased by the corporate cannibals' aggressive political lobbying and generous political donations to self-serving politicians . . . they are not the inevitable outcome of any inherent law of economics.

Weaponized Wealth

The market signal that President Calvin Coolidge sent to Wall Street and to the broader corporate sector leading to the Great Depression during the 1920s was the same signal that Presidents George W. Bush, Bill Clinton, and Fed Chairman Alan Greenspan and their acolytes sent to Wall Street and the corporate sector in the 2000s. These signals created the conditions that libertarians often claim are the ideal hands-off regulatory state of an economy. Their ideal state directly caused the Great Depression, the 2008 Financial Crisis, gigantic too-big-to-fail banks and the ongoing collapse of the human labor force.

Libertarians (including me when I was younger) often argue, "Crony capitalism is caused by government intervention. The solution is to privatize and deregulate everything!" What they don't seem to understand is that their "hands-off" ideology hand-cuffs citizens while giant banks and corporate cannibals manipulate the economy and political system without any meaningful accountability.

Then after the cannibals have siphoned off the vast majority of the wealth from the economy, they use that wealth as a weapon to buy media companies and capture politicians and the entire political system, which hand-cuffs the citizens even more. As we illustrate in our two most recent books (the Gini book and Broken Capitalism: This Is How We Fix It), none of these economic crises need to happen, but they inevitably happen when the "hands-off" ideology produces economic policies based on laissez faire fantasies instead of real-world socioeconomic realities.

In this case, the reality is that self-serving politicians will always intervene in every fiat economy to serve their political careers because every fiat economy is susceptible to political manipulation, by definition. The only meaningful question is: Will politicians intervene on behalf of giant corporate cannibals and super-wealthy donors or will they intervene on behalf of the broader citizen population? I think we all know the answer to that question.

Blinding Economic Ideology

The Great Depression, the 2008 Financial Crisis, and the ongoing debt and labor force catastrophes that are culminating into a looming Greatest Depression illustrate the danger of developing economic policy and economic systems based on blind economic ideology.

After the larcenous activity of the giant banks and holding companies, the most destructive element that caused and amplified the Great Depression was the economic ideology that blinded Presidents Coolidge and Hoover to the obvious realities of every real-world economy. When demand and supply were beginning to evaporate beginning in mid-1929, their ideological dogma of economic austerity at any cost compelled them to strangle the economy with extremely tight fiscal, monetary and trade policies at precisely the time when relatively flexible policies and much stronger banking regulation were needed.3

For example:

- The Smoot-Hawley Tariff Act of 1930 slammed the breaks on global trade and reduced U.S. imports at precisely the time when global trade balances between the U.S. and all other countries were already extremely lopsided.

- The Fed increased interest rates to curb inflation when deflation and corresponding debt liquidation and unemployment were the real-world problems looming over the economy.

- A religious adherence to the gold standard that forced every economy outside the U.S. to raise taxes during an economic recession to pay for their trade deficits (import surpluses). These trade deficits needed to be paid for in gold, which further amplified the deflationary spiral that was already unraveling the global economy. (A gold standard alone is not enough to produce sound money and a sound economy.)

Substantially the same ideological blinders infected the neoliberal Washington Consensus that has invaded our global economy since the early 1980s, which directly contributed to the 2008 Financial Crisis and is fundamentally responsible for the ongoing job apocalypse. (Automation is only part of the story.) The ideology of austerity at any cost and the corresponding nonsensical concept of contractionary economic expansion that has guided austerity cheerleaders (especially in the Eurozone) in recent years is like pouring superacid on your economy: It destroys everything it touches and it never works in the real world.

Are We Part of the Problem or the Solution?

"The only thing necessary for the triumph of evil is for good men to do nothing." That quote was Edmund Burke's response to the corruption of King George of England just a few years before the American Revolution ignited.4 Burke's courageous message is just as relevant and inspiring today for the ever-expanding population of economic refugees in the U.S. and around the world as it was 250 years ago.

Our friends on Wall Street and in other affluent communities on Earth are often resistant to these uncomfortable realities. To acknowledge these realities means we must either do something about it or live in a state of denial about the injustice of a system that produces more and more economic refugees every year . . . and this is just the beginning. This reality forces us to ask a basic question: Are we part of the problem or the solution?

As explained more deeply in the Gini book, these unnecessary boom-and-bust cycles destroy more wealth than they create; they redistribute wealth from the poor to the rich (That article only scratches the surface.); they keep our economy in a perpetual state of instability; and they increase the intensity and frequency of racial, class and social tensions that inevitably produce domestic terrorism, which is a far greater threat to the health, peace, prosperity and integrity of American society than foreign terrorism.

For those reasons and many more, the Gini ecosystem has meaningful built-in mechanisms of stability and anonymous accountability, which no other cryptocurrency or fiat economy has today. The Gini Platform is a nonpartisan economic model and a decentralized monetary system that provides hope to anybody who truly understands how tragically broken, self-destructive, inequitable and unsustainable our economic and political systems are today.

Notes:

1. See The Great Crash 1929 by John Kenneth Galbraith and Once in Golconda: A True Drama of Wall Street 1920-1938 by John Brooks for two of the most detailed and riveting historical accounts of the economic conditions and policies before, during and after the Great Depression.

2. Recent Trends in Household Wealth in the United States: Rising Debt and the Middle-Class Squeeze by Edward N. Wolff, Levy Economics Institute of Bard College.

3. The concept of "austerity" seems intuitively attractive to many conservatives and libertarians (including me when I was younger), but prescribing austerity while ignoring many other real-world economic factors is like telling a cancer patient to drink superacid to clean out their system. This is especially true when banks and giant corporate cannibals create the debt and then transfer their debts to their governments' balance sheets and enslave their citizens for generations. See Mark Blythe's rigorously researched and technically sound book, Austerity: The History of a Dangerous Idea if you don't believe "austerity at any cost" is a destructive economic ideology.

4. Variations of this quote exist, but it's widely attributed to Edmund Burke.

Did You Like This Resource?

Gini is doing important work that no other organization is willing or able to do. Please support us by joining the Gini Newsletter below to be alerted about important Gini news and events and follow Gini on Twitter.